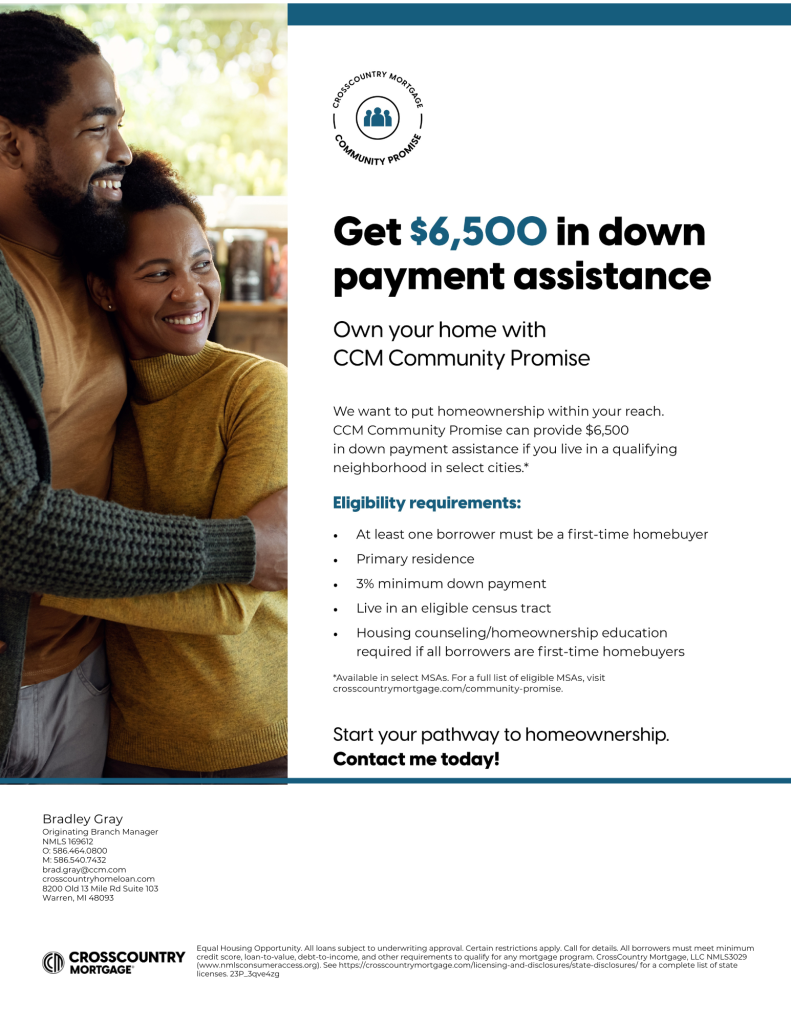

Crosscountry Mortgage, Brad Gray

Crosscountry Mortgage,

Brad Gray

- (586) 464-0800

- [email protected]

- crosscountrymortgage.com/Warren-MI-2307/

-

8200 E 13 Mile Rd, Suite 103

Warren, MI 48093 - NMLS ID# 169612

Crosscountry Mortgage

Our mortgage team is all about you! We come together to ensure your home loan journey is as smooth as can be. Each of us plays a crucial role, leveraging our expertise to create a seamless mortgage process that progresses effortlessly from start to finish. Our dedication to clear communication means you’ll always be in the know as your loan moves forward, and we’re here whenever you have questions. With a wide array of loan programs—from FHA and VA to conventional and jumbo—we have the knowledge and experience to match you with the perfect loan. Whether you’re buying, refinancing, or renovating, our team is here to deliver the exceptional mortgage experience you deserve!

A non-QM loan allows borrowers with non-traditional income and/or past credit events to get approved for a mortgage. CCM’s Signature Expanded series of products are proprietary, in-house, non-QM products that come with unique benefits to offer more options to more buyers. Educate your partners on how these products can benefit their clients.

Top 3 Tips for First-Time Home Buyers: Insights from a Loan Officer

Buying your first home is an exciting journey, and as a loan officer, I’m here to guide you through the process with some essential tips to make your experience smooth and successful.

1. Get Pre-Approved Early

Before you start house hunting, get pre-approved for a mortgage. This step not only gives you a clear idea of your budget but also shows sellers that you’re a serious buyer. A pre-approval letter can give you a competitive edge in a hot market.

2. Know Your Loan Options

There are various loan programs available, each with its own benefits. Familiarize yourself with different types of loans such as FHA, VA, conventional, and jumbo loans. Understanding your options can help you choose the best fit for your financial situation and long-term goals.

3. Budget for More Than the Down Payment

While the down payment is a significant expense, don’t forget about other costs associated with buying a home. Closing costs, home inspections, and potential repairs can add up. Make sure you have a comprehensive budget that includes these additional expenses to avoid any surprises.

By following these tips, you’ll be well-prepared for your first home purchase. Remember, I’m here to help you every step of the way, ensuring you have a positive and informed home buying experience. Happy house hunting!