Power Lending - Divorce

Power Lending - Divorce

Power Lending - Divorce

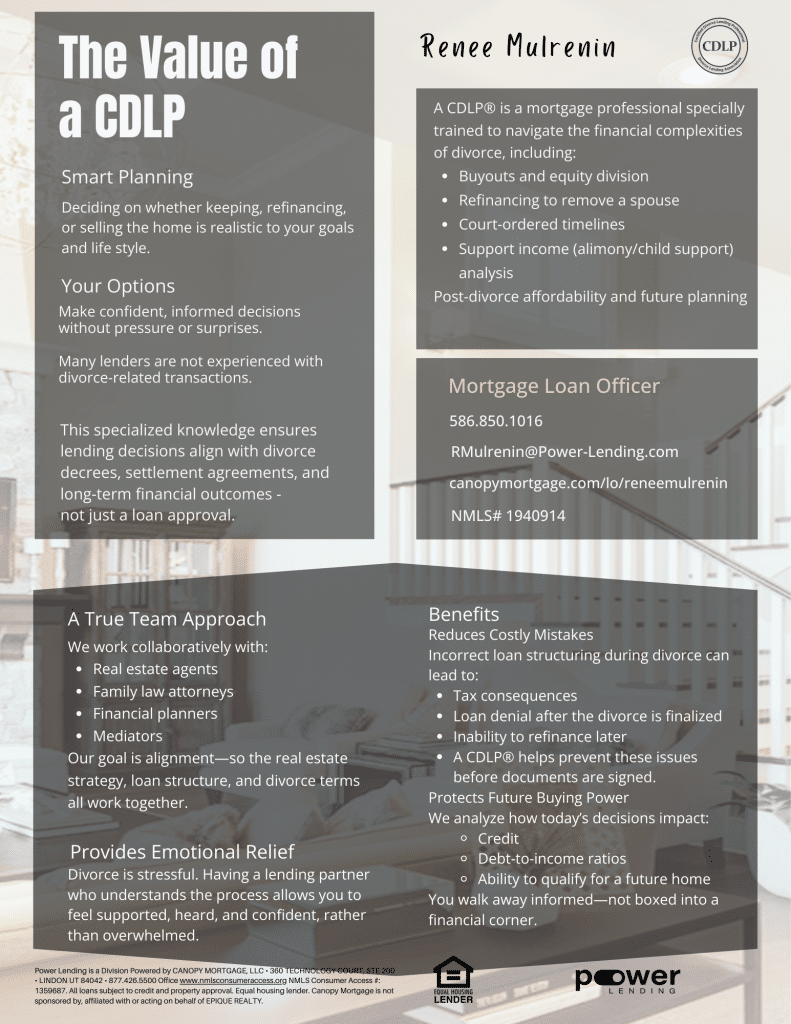

Divorce can be one of the most financially complex times in a person’s life, especially when a home or mortgage is involved. That’s where a Certified Divorce Lending Professional (CDLP®) becomes an essential part of the process. A CDLP® is a mortgage professional who is specially trained to work within the legal and financial framework of divorce, helping ensure that home financing decisions support both the settlement and long-term stability of each party.

From calculating buyouts and dividing home equity to handling refinancing that removes a former spouse, a CDLP® understands how to structure lending around court-ordered timelines and legal requirements. They are also trained to evaluate support income such as alimony and child support correctly, allowing for accurate qualification and affordability planning.

Most importantly, a CDLP® looks beyond simple loan approval. Their expertise ensures that mortgage solutions align with divorce decrees, settlement agreements, and future financial goals—helping clients move forward with clarity, confidence, and financial security.

Renee Mulrenin has been guiding clients through the mortgage process since January 2020, bringing clarity, structure, and confidence to what is often one of life’s biggest financial decisions. With experience serving first-time homebuyers, VA borrowers, and individuals navigating the challenges of divorce, Renee is known for her thoughtful, client-focused approach.

As a Certified Divorce Lending Professional (CDLP®), Renee provides specialized support for clients before, during, and after divorce—helping them understand how mortgage decisions impact equity division, refinancing, and long-term financial stability. She works closely within the legal and financial framework of divorce to ensure her clients’ lending strategies align with settlement agreements and future goals.

Whether helping someone secure their first home, remove a former spouse from a mortgage, or restructure financing after a major life change, Renee delivers personalized solutions designed to protect her clients’ financial well-being and support their next chapter.